If you’re thinking about investing but feel lost in the financial jargon, you’re not alone. One of the most important concepts to understand is securities. Whether you’re planning to invest in the stock market, buy bonds, or diversify your portfolio, knowing what securities are and how they work is your first step toward building wealth.

This guide will walk you through everything you need to know about securities in simple, everyday language.

What Exactly Are Securities?

At its core, a security is simply a financial instrument that represents value and can be bought or sold. Think of it like owning a piece of paper that says you own something valuable or that someone owes you money.

When you buy a security, you’re essentially investing money in the hope of making a profit or earning income over time. These are tradable assets—meaning you can buy them, hold them, and sell them whenever you want (in most cases).

To delve deeper, let’s explore what securities are and how they can fit into your investment strategy.

Why Are They Called “Securities”?

The word “security” comes from the concept of legal protection. When you buy a security, it’s a legally documented claim. The document (or digital record) acts as proof of your ownership or your claim, which is why it’s called a “security.”

In the Indian financial market, the Securities and Exchange Board of India (SEBI) is the regulatory body that oversees and protects securities trading. SEBI ensures that all transactions are fair, transparent, and that investors’ interests are protected.

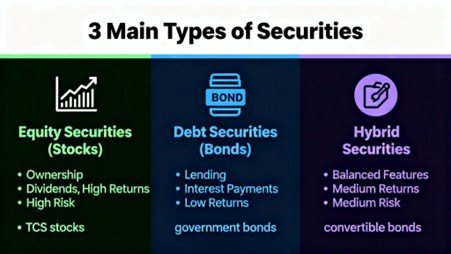

The Three Main Types of Securities

Not all securities are the same. They come in different varieties, each with its own characteristics, risk levels, and potential returns. Let’s break down the main types:

Equity Securities (Shares)

When you buy equity securities, you’re buying ownership in a company. This ownership is represented by shares or stock.

Here’s what you need to know about equity securities:

Buying equity means owning a piece of a company—small or large, depending on how many shares you hold. This ownership gives you:

- A share in the company’s long-term growth

- The chance to vote on major business decisions

- A possible share of profits through dividends

Example:

Imagine purchasing 40 shares of a company at ₹2,800 each. If the market later values those shares at ₹3,200, the value of your holding rises accordingly.

Why do some investors choose equity:

- Potential to build significant wealth over time

- Shares can be sold easily on major stock exchanges

- Opportunity to benefit directly from corporate success

Risks to consider:

- Prices can shift sharply within short periods

- Dividends are not guaranteed

- In cases of liquidation, equity holders are paid last

Debt Securities (Bonds, Debentures)

Debt securities work differently. Here, you become the lender, and the issuer becomes the borrower. In return, you receive interest at agreed intervals and get your principal amount back when the security matures.

Key elements:

- Interest income is generally predictable

- Maturity dates can span from months to decades

- Credit quality depends on the issuer’s financial strength

Example:

If you invest ₹1,00,000 in a 6.5% corporate bond, you receive ₹6,500 per year until maturity, assuming the issuer continues to make timely payments.

Why do some investors prefer debt?

- Lower volatility compared to stocks

- Stable income stream

- Useful for short- to medium-term financial planning

Main risks:

- Lower returns than equities

- Possible default by the issuer

- Bond values may fall if market interest rates rise

Hybrid Securities

Hybrid instruments blend traits of both debt and equity, offering a middle path for investors who want balanced risk.

Common hybrid forms include:

- Preference shares – Fixed dividend potential with priority over equity holders

- Convertible bonds – Start as debt but can later be turned into shares. These instruments appeal to investors who want a mix of stability and growth options.

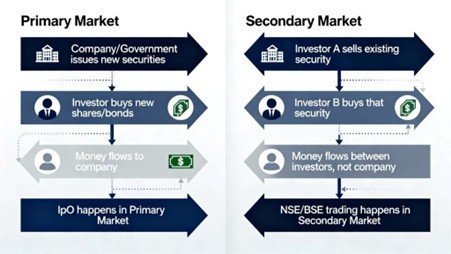

Where Securities Are Traded: Two Key Markets

Understanding the flow of securities becomes easier when we divide the market into two parts.

Primary Market: The Starting Point

The primary market is where issuers sell securities for the first time. When a company launches an IPO, or when a corporation privately issues bonds to institutional investors, the money flows directly from investors to the issuer.

Common primary market activities include:

- Initial Public Offerings (IPOs)

- Private placements

- Rights issues for existing shareholders

Secondary Market: The Everyday Trading Arena

After the initial sale, securities move to the secondary market, where investors buy and sell among themselves. The issuer receives no new funds at this stage—only the ownership changes hands.

In India, the NSE and BSE serve as the most prominent secondary marketplaces, offering:

- Easy liquidity

- Transparent price discovery

- Continuous trading during market hours

Essential Characteristics of Securities

When evaluating any security, keep these attributes in mind:

Liquidity

Indicates how quickly and efficiently you can convert the security into cash. Large, popular stocks tend to be highly liquid, while certain bonds or niche securities may require more time to find buyers.

Credit Strength

Most relevant for debt. Rating agencies like CRISIL, ICRA, and CARE assess the issuer’s ability to repay.

Maturity Period

Applies to debt and hybrid instruments. The longer the maturity, the higher the uncertainty—and potentially, the higher the return.

Risk vs. Reward

Every security lives somewhere on the risk–return spectrum.

- Equity: greater swings, higher long-term reward potential

- Debt: steadier, predictable income

- Hybrid: a compromise between the two

Why Should You Use Securities

Building Long-Term Wealth

Equities, when chosen with care and held for years, can grow substantially and outpace inflation.

Earning a Regular Income

Debt instruments and dividend-paying stocks can generate periodic payouts.

Diversifying Your Portfolio

Because each type of security responds differently to economic changes, combining them helps reduce overall risk.

Flexibility and Liquidity

Unlike real estate or fixed-term instruments, many securities can be sold quickly when needed.

Key Points to Remember

- Securities represent ownership, lending, or a hybrid of both.

- Equity suits long-term wealth creation; debt offers stability; hybrids provide balance.

- Securities originate in the primary market and are traded daily in the secondary market.

- Consider liquidity, credit quality, maturity, and risk profile before investing.

- Match your investments to your financial goals and risk tolerance.

- SEBI plays a central role in safeguarding investor interests.

- Diversification remains one of the most effective risk-management tools.

Final Thoughts

You don’t need to be a financial expert to start investing in securities. The key is to understand what you’re buying and how it aligns with your life goals. Begin with manageable amounts, stay consistent, and continue learning as markets evolve.

A thoughtful, diversified approach can help you steadily build confidence—and wealth—over time.